I. Intro

The DISC function calculates the discount rate of a security.

II. About the function

- Formula: = DISC(settlement,maturity,pr,redemption,frequency,[basis])

- Parameters:

- settlement (required): The settlement date of the security (the date after the issue date when the buyer takes ownership of the security).

- maturity (required): The maturity date or end date of the security (the date when the security can be redeemed at face or par value).

- pr (required): The purchase price of the security (per $100 face value).

- redemption (required): The redemption value of the security (per $100 face value or par value).

- [basis] (optional): The method used to calculate the number of days in a year. See COUPDAYSNC for more details.

- Example: =DISC("2010-1-2","2039-12-31",90,100,0)

- Note:

- If settlement is not a valid date, then the error value #VALUE! is returned.

- If pr ≤ 0 or if redemption ≤ 0, then the error value #NUM! is returned.

- If [basis] < 0 or > 4, then the error value #NUM! is returned.

- If settlement ≥ than maturity, then the error value #NUM! is returned.

III. Steps

Use the DISC function

- Select a cell and enter =DISC.

- Enter the parameters in the cell. For example: =DISC("2010-1-2","2039-12-31",90,100,0).

- Press Enter to display the result, which is 0.003333642 in this example.

250px|700px|reset

Delete the DISC function

Select the cell with the DISC function, and press Delete.

IV. Use cases

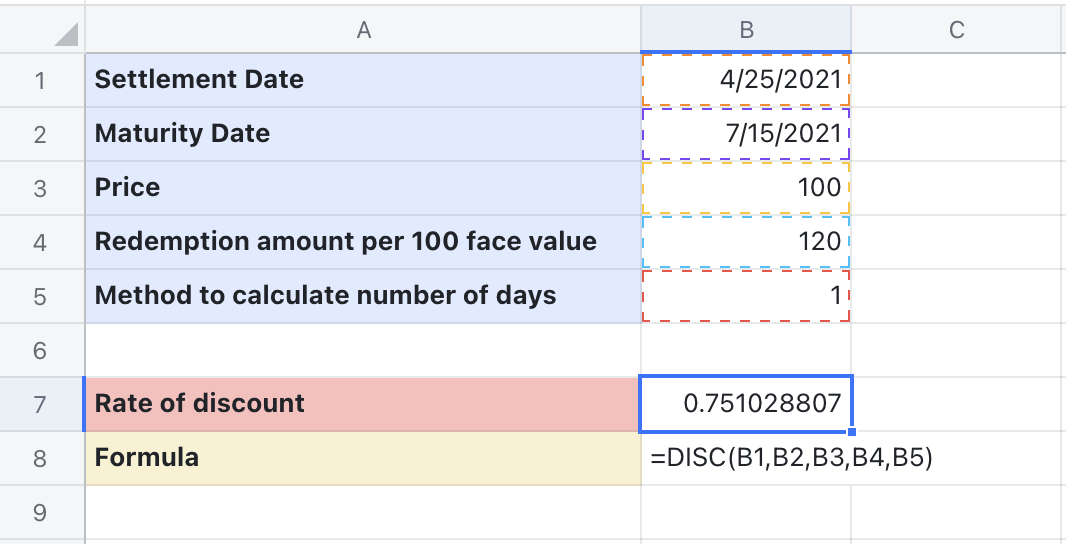

Financial management: Calculate the discount rate

If you know the pricing and settlement and maturity dates of a security, you can use the DISC function to calculate its discount rate.

- Formula used below: =DISC(B2,B3,B4,B5,B6)

- About the parameters:

- Click B2 and B3. Make sure the settlement date in B2 is earlier than B3's maturity date.

- Click the price in B4, the redemption amount in B5, and 1 in B6.

- Press Enter to get the discount rate.

250px|700px|reset