Investor Meeting

This guide will walk you through the essential elements of use investor meeting to keep your attendees aligned and engaged.

Try Lark for Free

In modern business realms, conducting investor meetings with finesse is a vital aspect of securing vital investments and fortifying corporate relationships. Successfully hosting these meetings necessitates calculated planning, precise execution, and an astute understanding of contemporary market dynamics.

Use Lark Meetings to turn meetings into true collaborative experiences.

What is an investor meeting?

An investor meeting, commonly known as a shareholder meeting or a stockholder meeting, is a significant corporate gathering where stakeholders, shareholders, and financial experts convene to discuss the company's performance, prospects, and critical strategic decisions. These meetings serve as a platform for sharing crucial financial statistics, unveiling growth plans, and addressing investor concerns, thereby influencing vital corporate decisions and propelling the company forward by securing support from existing and potential investors.

Goals of an investor meeting

The primary goals of an investor meeting encompass several essential elements:

-

Effectual Communication: Transparently convey the company's financial achievements, growth trajectory, and potential risks to the investors.

-

Fostering Confidence: Instill a sense of trust and assurance among the investors regarding the company's commitment to its stakeholders and its capacity to deliver impressive returns.

-

Securing Support: Encourage investment, cultivate investor loyalty, and potentially attract new backers through compelling presentations and strategic insights.

-

Gathering Feedback: Facilitate interactive sessions to capture and address investor queries and feedback, fostering a collaborative atmosphere and demonstrating openness.

Key attendees of investor meetings

Essential participants in an investor meeting include:

-

Shareholders: Individuals who own a portion of the company's stock.

-

Board of Directors: Key decision-makers crucial to outlining the company's vision and strategy.

-

Financial Analysts: Professionals dedicated to scrutinizing financial data and providing valuable insights.

-

Company Executives: The leadership team, including CEO, CFO, and other key personnel, responsible for managing the company's operations and future direction.

-

Potential Investors: Prospective backers keen on evaluating the company's potential for investment.

Each participant carries a distinct role, collectively contributing to the comprehensive understanding and fruitful outcomes of the investor meeting.

Learn more about Lark x Meetings

Topics, agenda, and structure of investor meetings

An effectively structured investor meeting aligns with the following core topics:

-

Financial Performance: Delving into the company's financial stability, profit margins, revenue growth, and future forecasts.

-

Strategic Roadmaps: Unveiling the vision and strategic initiatives to drive market relevance and sustainable growth.

-

Market Dynamics Analysis: Addressing shifts in market dynamics, competitive positioning, and associated challenges and opportunities.

-

Risk Management: Detailed insights into potential risks, risk mitigation strategies, and the impact of external factors on the business.

The meeting agenda must be meticulously crafted to accommodate comprehensive discussions on the above subjects, while also affording sufficient time for investor queries and feedback.

Learn more about Lark x Meetings

Frequency of investor meetings

The frequency of investor meetings hinges on several factors, notably:

-

Company Size: Larger corporations often conduct quarterly meetings, whereas smaller entities may opt for semi-annual gatherings.

-

Market Dynamics: Fluctuations in market conditions, mergers, acquisitions, and pivotal transitions may warrant supplementary investor meetings.

-

Strategic Objectives: Introducing a new product, unveiling an innovative strategy, or addressing major corporate restructuring may necessitate ad-hoc investor meetings.

Key differences between investor meetings and other similar meetings

Investor meetings significantly diverge from general business meetings or quarterly progress reviews based on several distinct characteristics:

- Focus on Financials: While general business meetings address various corporate aspects, investor meetings primarily revolve around financial performance and future financial prospects.

- Legal Obligations: Investor meetings often adhere to strict regulatory frameworks and mandates, contrasting with the flexibility of other internal or external corporate gatherings.

Learn more about Lark x Meetings

Practical examples of successful investor meetings

Example 1: Transformation through Transparency

An esteemed technology conglomerate, TechTrend Inc., orchestrated an investor meeting designed to transparently address a market share downturn. By candidly outlining strategic alterations, the company restored investor confidence, culminating in substantial capital influx and amplified stock values.

Example 2: Strategic Vision Clarity

StrataCom Group, a leading real estate developer, executed a breakthrough investor meeting that precisely elucidated its strategic roadmap, fostering a unified vision and garnering enthusiastic investor buy-ins toward substantial expansion initiatives.

Example 3: Crisis Mitigation and Recovery

A notable energy corporation, grappling with a PR crisis, organized an investor meeting centering on crisis management and recovery strategies. Transparently acknowledging the adversities, the company instilled confidence through robust mitigation plans, assuaging investor concerns and reversing market downturns.

Common pitfalls of investor meetings

Navigating investor meetings often encounters challenges, including:

- Information Overload: Fostering succinct, impactful communication while avoiding overwhelming investors with superfluous data.

- Market Volatility: Astutely addressing unexpected market shifts and effectively repositioning the company's prospects amidst volatility.

Dos and Don’ts of Conducting Investor Meetings

| Do's | Don'ts |

|---|---|

| Establish clear communication channels | Avoid excessive technical jargon |

| Prepare thorough and impactful presentations | Don't overlook attendee engagement and feedback |

| Cultivate a transparent and open discussion | Avoid misrepresenting financial data and projections |

| Encourage a Q&A session for comprehensive insights | Don't neglect to follow up post-meeting with updates |

Learn more about Lark x Meetings

Keys to a successful virtual investor meeting

Evolving virtual investor meetings necessitate specific considerations, including:

-

Impeccable Technological Infrastructure: Ensure seamless connectivity, presentation quality, and minimal technical disruptions.

-

Digital Engagement Tools: Incorporate interactive features like polls, surveys, and virtual breakout rooms to amplify the interactive experience.

Typical takeaways of an investor meeting

Leaving a lasting impact through an investor meeting entails several key takeaways:

-

Assured Investor Support: Garnering investor confidence and support through compelling vision clarity and strategic foresight.

-

Enhanced Corporate Visibility: Elevating the company's market standing through transparent communication and strategic unveiling of future prospects and growth.

Learn more about Lark x Meetings

Essential questions in an investor meeting

Addressing pivotal questions can significantly enrich the discourse during an investor meeting, such as:

- Understanding investors' risk appetite and investment preferences.

- Inquiring about concerns regarding the company's internal and external growth prospects.

- Clarifying the company's stance on pertinent market dynamics and competitive positioning.

Conclusion

Successfully orchestrating an investor meeting is a multifaceted endeavor that demands meticulous planning, strategic execution, and a keen understanding of contemporary market dynamics. The potency of a well-conducted investor meeting echoes through strengthened alliances, bolstered investor confidence, and propitious business growth.

Learn more about Lark x Meetings

Use Lark Meetings to turn meetings into true collaborative experiences.

A Game Changer for Investor Meeting: Empower your team with Lark Meetings

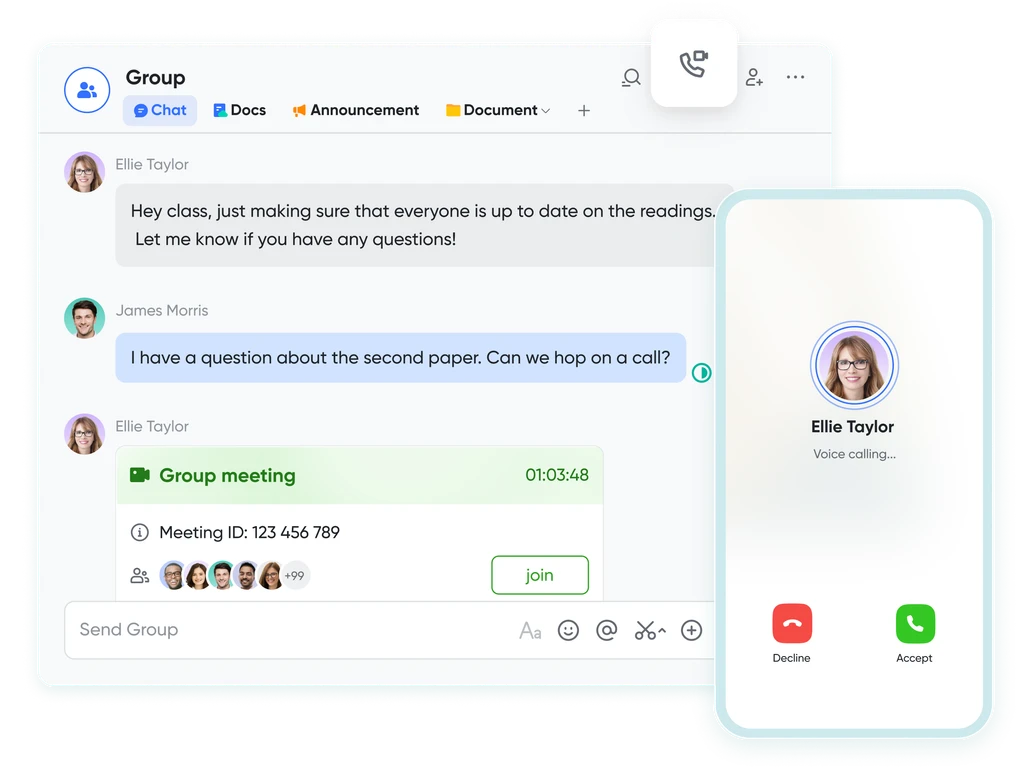

In the fast-paced and dynamic world of modern business, effective communication and collaboration are crucial for success of Investor Meeting. Here we introduce Lark Meetings to serve as a centralized hub for all communication needs.

Transform your meetings into collaborative endeavors

Leverage the potency of in-call document sharing, intelligent meeting minutes, and mobile-optimized features to enhance productivity collaboratively, irrespective of your location or schedule.

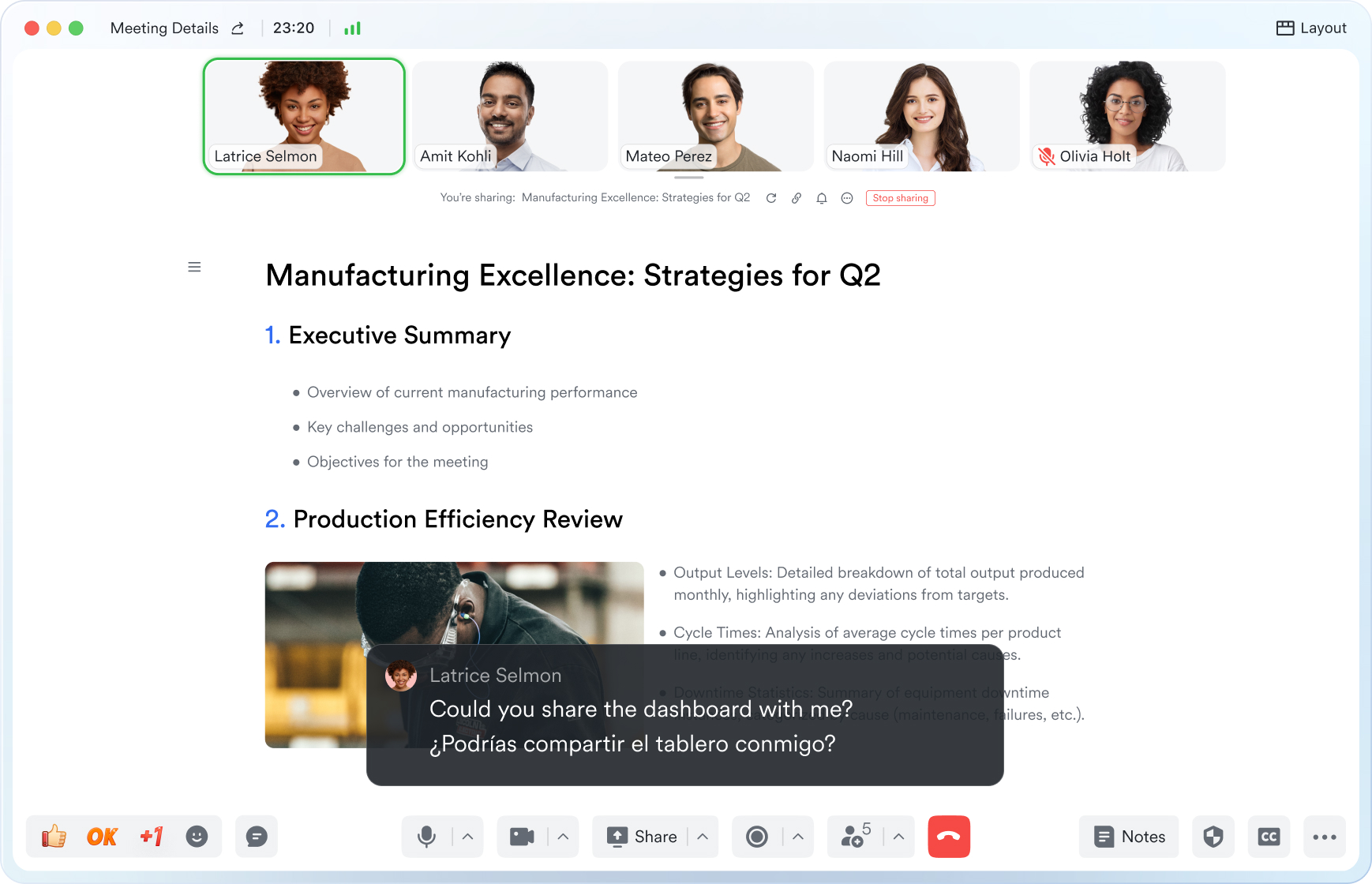

Seamlessly collaborate in real-time, across any device

Share live documents instead of just screen views. Participants can navigate and edit simultaneously within the video call window, even while on the move.

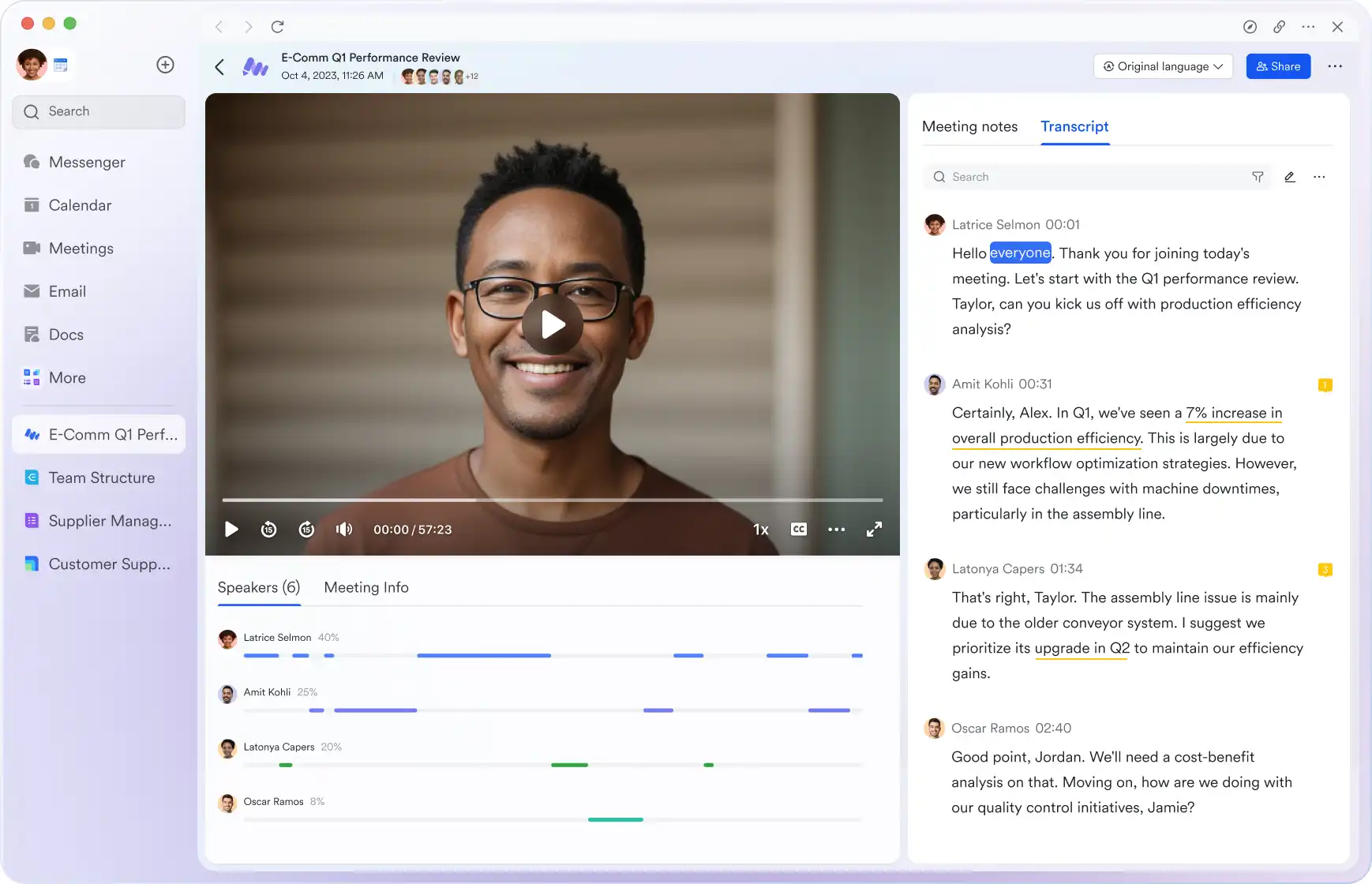

Shift your focus to engagement, not note-taking

Lark Minutes automatically converts video meetings into transcripts, facilitating easy viewing, searching, and collaborative editing. Stay in the loop asynchronously, even if you can't attend the live meeting. Lark Minutes for meeting minutes support translation into 10+ different languages.

Break language barriers in communication

Lark Meetings provide real-time translation for subtitles, allowing individuals from diverse backgrounds to express themselves in their native languages. Ensure every voice is heard, regardless of geographical location. Live subtitles currently support translations from English, Chinese, and Japanese to 10+ different languages. See more translation feature in Lark.

Connect with larger audiences

Host dynamic online meetings and events accommodating up to 1,000 participants, with the flexibility of up to 50 breakout sessions for intimate group discussions within the larger meeting context. Try more Lark features for free.