Financial Meeting

This guide will walk you through the essential elements of use financial meeting to keep your attendees aligned and engaged.

Try Lark for Free

In today's dynamic business landscape, the successful orchestration of financial meetings is pivotal to an organization's financial stability and growth. These meetings serve as crucial platforms for strategic decision-making, financial planning, and performance evaluation. However, to ensure the efficacy of these gatherings, a comprehensive understanding and adept management are imperative. This comprehensive guide is designed to equip organizational leaders and meeting facilitators with the insights, strategies, and best practices required to conduct impactful financial meetings in 2024.

Use Lark Meetings to turn meetings into true collaborative experiences.

What is a financial meeting?

Financial meetings encompass dedicated gatherings where key stakeholders convene to deliberate on various aspects of an organization's financial strategies, performance, and planning. These meetings play a pivotal role in steering the financial trajectory of an organization, fostering transparency, and enabling informed decision-making. In essence, they serve as pivotal forums for aligning financial goals with operational strategies and ensuring organizational financial health.

Goals of financial meetings

The primary objectives of financial meetings are multifaceted, aiming to achieve the following:

- Facilitate in-depth analysis and review of financial performance metrics.

- Foster strategic discussions on resource allocation, investment opportunities, and risk mitigation.

- Enable informed decision-making on budgetary planning and forecasting.

- Cultivate an environment of transparency and accountability in financial management.

- Drive actionable takeaways for implementing strategic financial initiatives.

Achieving these goals is integral to leveraging financial meetings as catalysts for organizational growth and resilience.

Who should attend financial meetings?

Financial meetings necessitate the participation of diverse stakeholders to ensure comprehensive input, decision-making, and implementation. Key attendees typically include:

- C-Suite Executives: Their strategic insights and decisions significantly impact the financial landscape.

- Financial Officers: Their expertise and analysis aid in steering financial planning and governance.

- Department Heads: Their operational perspectives inform financial decision-making and resource allocation.

- External Advisors: Their specialized knowledge contributes to enriching financial discussions and strategies.

Collaborative involvement of these stakeholders is instrumental in driving holistic financial deliberations and outcomes.

Related:

Master the Art of Meeting Notes with Lark for Enhanced Collaboration | Lark Blog | Lark BlogLearn more about Lark x Meetings

Topics, agenda, and structure of financial meetings

A well-crafted agenda is the cornerstone of a successful financial meeting, encompassing various topics such as:

- Financial Performance Review: Analyzing financial statements, KPIs, and benchmarking against targets.

- Budgetary Planning: Deliberating on budget allocations, investment priorities, and cost management strategies.

- Risk Assessment and Mitigation: Identifying potential financial risks and formulating risk response strategies.

- Strategic Financial Planning: Aligning financial goals with organizational strategies and initiatives for future growth.

The structured flow of the meeting, commencing with essential topics and gradually transitioning to strategic deliberations, is vital for ensuring a productive and meaningful engagement.

Learn more about Lark x Meetings

How often does a financial meeting occur?

The frequency of financial meetings is largely dependent on the organizational dynamics, financial activities, and strategic planning cycles. Typically, organizations conduct:

- Quarterly Financial Reviews: Evaluating short-term financial performance and planning.

- Annual Budgetary Conferences: Setting long-term financial goals and resource allocations.

- Ad-Hoc Strategic Planning Summits: Addressing emergent financial opportunities or challenges.

Adhering to a well-structured meeting cadence ensures consistent monitoring and adaptability in financial decision-making.

Key differences between financial meetings and other similar meetings

Financial meetings are distinct from other organizational gatherings due to their focused and specialized nature, characterized by:

- Strategic Financial Focus: Singularly centered on financial planning, performance review, and resource allocation.

- In-depth Data Analysis: Comprehensive scrutiny of financial reports, market trends, and investment opportunities.

- Decision-Making Intensity: Emphasizing critical financial decisions and their impact on organizational direction.

These differentiators underscore the specialized expertise and strategic acumen required for effective financial meetings.

Learn more about Lark x Meetings

Three practical examples of financial meetings

Example 1: quarterly financial review meeting

Example 1: quarterly financial review meeting

In this scenario, the purpose of the meeting revolves around a comprehensive review of the organization's financial performance during the past quarter, aligning it with projected goals and identifying areas of improvement.

Example 2: budget allocation symposium

Example 2: budget allocation symposium

This meeting focuses on the meticulous allocation of budgetary resources across organizational initiatives, factoring in strategic priorities and anticipated financial outcomes.

Example 3: strategic financial planning summit

Example 3: strategic financial planning summit

A gathering dedicated to forecasting future financial strategies, assessing potential risks, and crafting actionable plans to steer the organization towards sustainable growth and profitability.

Common pitfalls of financial meetings

Effective financial meetings necessitate vigilant avoidance of various common pitfalls, including:

- Unfocused Discussion: Straying away from the key agenda items and engaging in irrelevant discussions.

- Decision-Making Hurdles: Inability to reach consensus on critical financial decisions, leading to prolonged deliberations.

- Insufficient Data Analysis: Overlooking comprehensive financial data analysis, resulting in suboptimal decisions.

- Communication Inefficiencies: Inadequate articulation of financial strategies, leading to misunderstanding and misalignment.

Addressing these pitfalls requires proactive measures and a steadfast commitment to adherence to meeting best practices.

Related:

Unlock the Power of Webinars: A Comprehensive Guide to Boost Your Business | Lark Blog | Lark BlogLearn more about Lark x Meetings

Dos and don'ts of financial meetings

| Do’s | Don’ts |

|---|---|

| Foster open and inclusive dialogue. | Avoid rigid adherence to the agenda. |

| Prioritize data-driven discussions. | Neglect to consider diverse viewpoints. |

| Encourage active participation. | Overshadow stakeholders’ contributions. |

| Facilitate constructive feedback. | Disregard the time constraints. |

What makes a virtual financial meeting successful?

The success of virtual financial meetings hinges on several critical factors, including:

- Technological Resilience: Reliable virtual meeting platforms and seamless connectivity.

- Enhanced Engagement Tools: Utilization of interactive features to promote engagement and collaboration.

- Security Protocols: Implementation of robust data security measures for confidential financial discussions.

Addressing these foundational components ensures the seamless orchestration of successful virtual financial meetings.

Learn more about Lark x Meetings

Typical takeaways of financial meetings

Financial meetings yield diverse takeaways, including:

- Informed Decision-making: Strategic and insightful financial decisions based on comprehensive analyses.

- Actionable Strategies: Clear and actionable plans for financial resource allocation and risk mitigation.

- Operational Alignment: Enhanced coordination between financial strategies and organizational operations.

These takeaways serve as the bedrock for driving organizational growth and financial resilience.

Questions to ask in financial meetings

Curating the right questions is essential for fostering meaningful conversations and insightful discussions, including:

- What are the key performance indicators (KPIs) driving our current financial trajectory?

- How can we optimize our budget allocations to enhance investment returns while mitigating risks?

- What are the potential financial challenges we anticipate, and how can we proactively address them?

- How can our current financial strategies be aligned with long-term organizational objectives?

Engaging with these critical questions nurtures richer financial dialogue and decision-making.

Learn more about Lark x Meetings

Conclusion

Successfully navigating the intricacies of financial meetings in 2024 demands adept management, comprehensive preparation, and strategic facilitation. By embracing the insights, strategies, and best practices outlined in this guide, organizational leaders and meeting facilitators can empower themselves to orchestrate impactful and transformative financial meetings, propelling their organizations towards sustained financial success.

Learn more about Lark x Meetings

Use Lark Meetings to turn meetings into true collaborative experiences.

A Game Changer for Financial Meeting: Empower your team with Lark Meetings

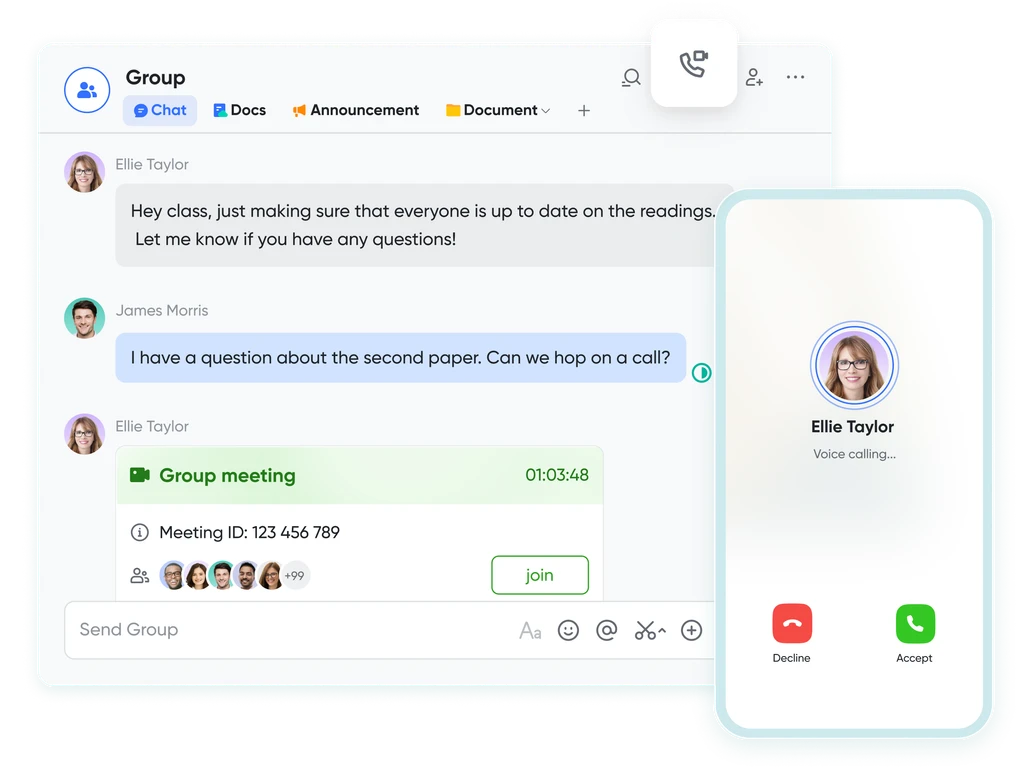

In the fast-paced and dynamic world of modern business, effective communication and collaboration are crucial for success of Financial Meeting. Here we introduce Lark Meetings to serve as a centralized hub for all communication needs.

Transform your meetings into collaborative endeavors

Leverage the potency of in-call document sharing, intelligent meeting minutes, and mobile-optimized features to enhance productivity collaboratively, irrespective of your location or schedule.

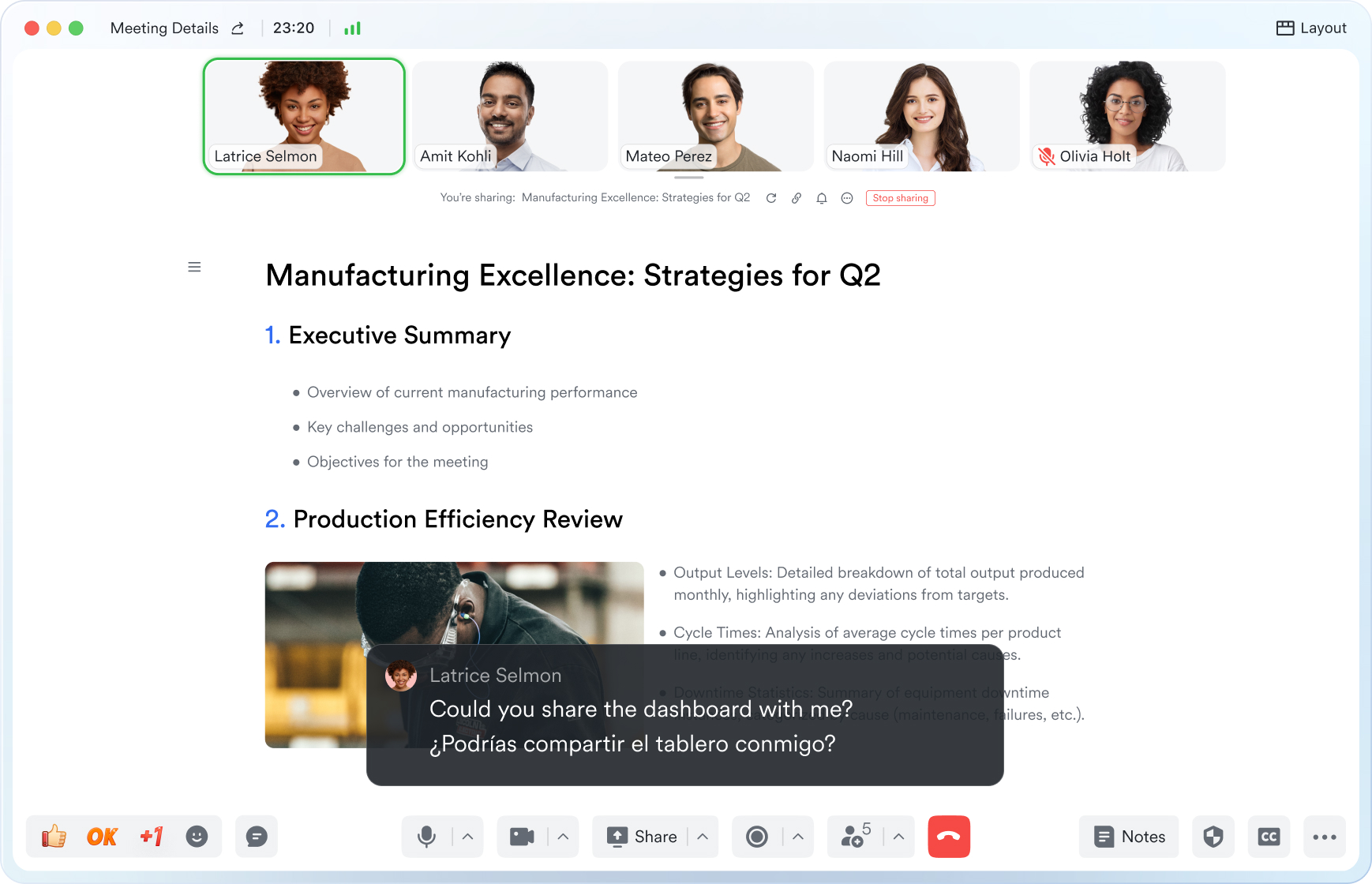

Seamlessly collaborate in real-time, across any device

Share live documents instead of just screen views. Participants can navigate and edit simultaneously within the video call window, even while on the move.

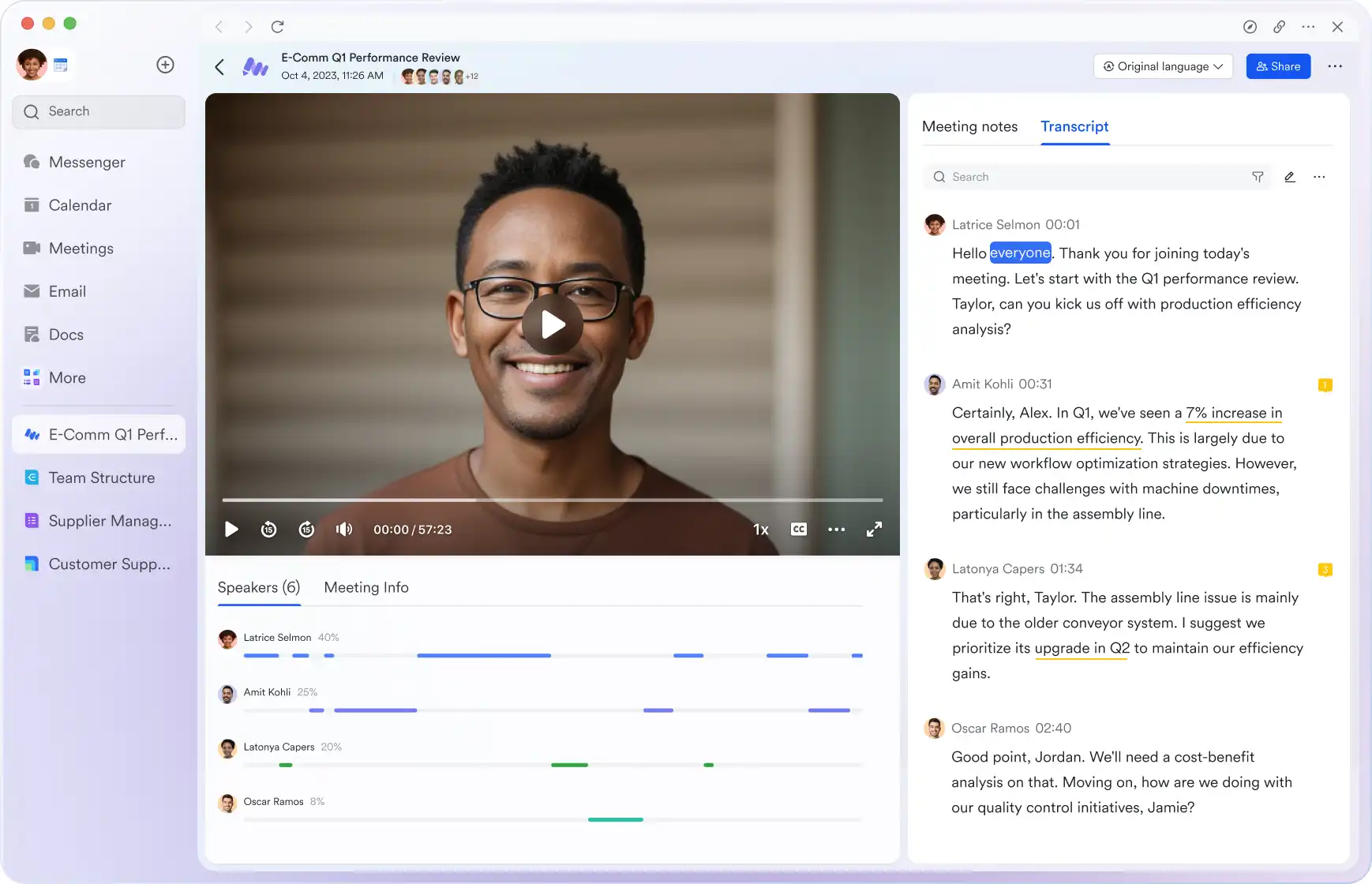

Shift your focus to engagement, not note-taking

Lark Minutes automatically converts video meetings into transcripts, facilitating easy viewing, searching, and collaborative editing. Stay in the loop asynchronously, even if you can't attend the live meeting. Lark Minutes for meeting minutes support translation into 10+ different languages.

Break language barriers in communication

Lark Meetings provide real-time translation for subtitles, allowing individuals from diverse backgrounds to express themselves in their native languages. Ensure every voice is heard, regardless of geographical location. Live subtitles currently support translations from English, Chinese, and Japanese to 10+ different languages. See more translation feature in Lark.

Connect with larger audiences

Host dynamic online meetings and events accommodating up to 1,000 participants, with the flexibility of up to 50 breakout sessions for intimate group discussions within the larger meeting context. Try more Lark features for free.